"Absolute Returns, founded in 2007, is an independent managed futures and alternative investment performance database for both individual investors and brokers. Managers report to our database directly.

You can look at various funds, CTA's etc, it's quite interesting looking at their historic equity curve and their disclosure docs that details the strategy employed.

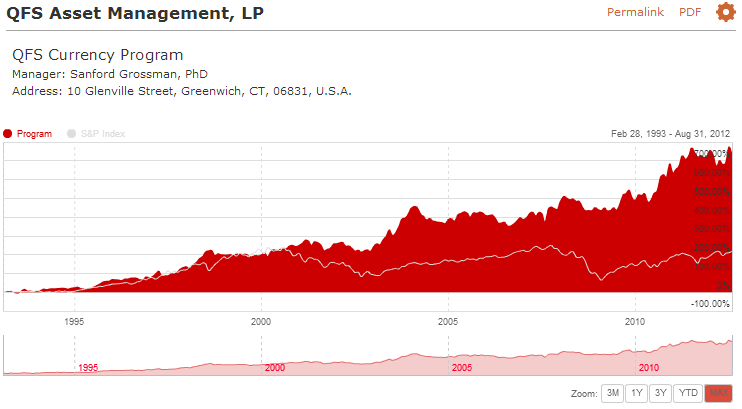

Here's one that stands out;

The background of the manager also stands out;

"Sanford J. Grossman earned his B.A. in 1973, M.A. in 1974 and PhD in 1975, all in Economics, from the University of Chicago. Since receiving his doctorate, he has held academic appointments at Stanford University, the University of Chicago, Princeton University (as the John L. Weinberg Professor of Economics, 1985-89) and at the University of Pennsylvania's Wharton School of Business. At Wharton, Dr. Grossman held the position of Steinberg Trustee Professor of Finance from 1989 to 1999 (a title now held in Emeritus) and also served as the Director of the Wharton Center for Quantitative Finance (1994 - 1999).

In addition, Dr. Grossman was an Economist with the Board of Governors of the Federal Reserve System (1977-78), and was a Public Director of the Chicago Board of Trade (1992-96). In 1988, he was elected a Director, in 1992 served as Vice President, and in 1994 was President of the American Finance Association.

Dr. Grossman's research has spanned the analysis of information in securities markets, corporate structure, property rights, and optimal dynamic risk management. He has published widely in leading economic and business journals, including American Economic Review, Journal of Econometrics, Econometrica and Journal of Finance. His papers include "The Existence of Futures Markets, Noisy Rational Expectations and Information Externalities"; "On the Efficiency of Competitive Stock Markets Where Traders Have Diverse Information"; "On the Impossibility of Informationally Efficient Markets," with Joseph Stiglitz; "An Introduction to the Theory of Rational Expectations Under Asymmetric Information"; and "The Costs and Benefits of Ownership: A Theory of Vertical Integration," with Oliver Hart. Dr. Grossman's original contributions to economic research received official recognition when he was awarded the John Bates Clark Medal by the American Economic Association at its December 1987 annual meeting. The Q-Group awarded him first prize in The Roger F. Murray Prize competition for the paper "An Analysis of the Implications for Stock and Futures Price Volatility of Program Trading and Dynamic Hedging Strategies." The Editorial Board of the Financial Analysts Journal awarded him the 1988 Graham and Dodd Scroll for "Program Trading and Market Volatility: A Report on Interday Relationships." Dr. Grossman received a Mathematical Finance 1993 Best Paper Award for his article "Optimal Investment Strategies for Controlling Drawdowns." Dr. Grossman received the 1996 Leo Melamed Prize by the University of Chicago Graduate School of Business for outstanding scholarship by a professor. In 2002, Dr. Grossman was recognized by the University of Chicago with its Professional Achievement Citation. Most recently, he was awarded the 2009 CME Group-MSRI Prize in Innovative Quantitative Applications.

Currently, Dr. Grossman applies his rigorous scientific approach to improving and developing systematic investment strategies and risk controls for QFS."

$811 Mill assets under managemnt, minimum investment $250K. Counts me out.

No comments:

Post a Comment