A difficult market to navigate today and unusual too - 7 trades and I ended the day only up by a small margin.

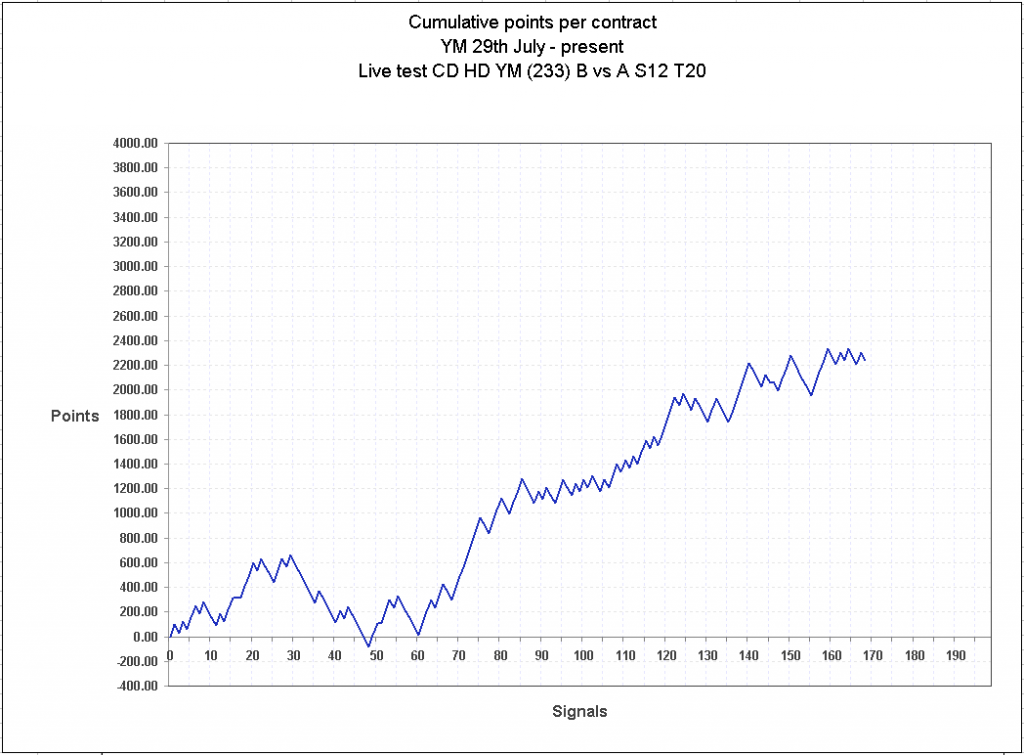

I am now at the 3 month point with this strategy and here is where I stand.

This is the sort of performance I am looking for. The Dow Jones Industrial Average has a low number of constituent components (30) with the main publically owned large cap businesses in the US. I think that and the large cap nature of the index combine to provide less long term volatility and perhaps that explains why my strategy and trading matches well with that market.

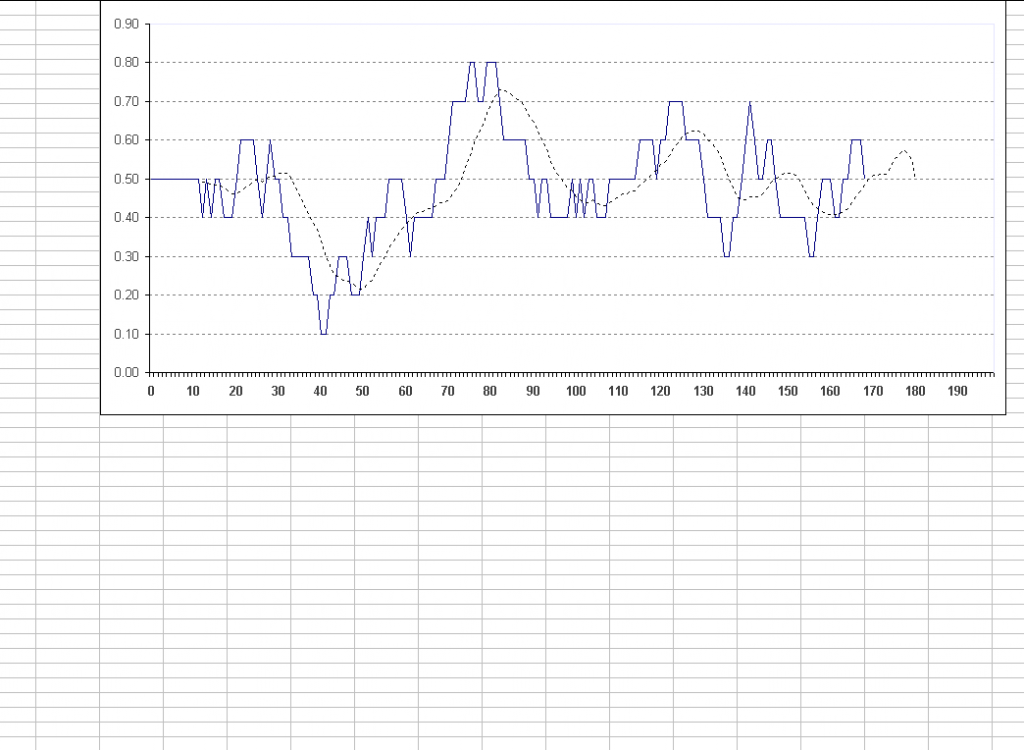

I looked at the long term volatility of;

the Dow Jones Industrial Average using VXD

the S&P 500 using VIX

the NASDAQ 100 using VXN

the Russell 2000 index RVX

Over the last 8 years

The Dow Jones Industrial Average is typically less volatile than the S&P 500, at least using this measure. I was surprised to see that the NASDAQ 100 volatility in grey has typically been lower than the S&P 500 and Dow Jones Industrial Average. Most of the time the Russell 2000 has been the least volatile from this perspective.

I'll need to assess the possibility of using these same techniques on perhaps the NASDAQ 100 futures and/or the Russell 2000 futures. The S&P 500 is one to avoid, it seems overladen with ultracompetitives colliding with each other.

Volumes of the different futures markets;

There ought to be better opportunities in lower volume markets - less competition - and on that basis the Russell 2000 is more attractive than the NASDAQ 100.

No comments:

Post a Comment