1. Trading an edge on an intra-day basis.

2. Trading divergences between currency and equity index markets and divergences between individual equity index markets.

3. Special situations identified where a large opportunity develops in a specific market.

1. Refers to my day to day trading that I regularly write about on these pages.

2. Relates to scenarios such as the following;

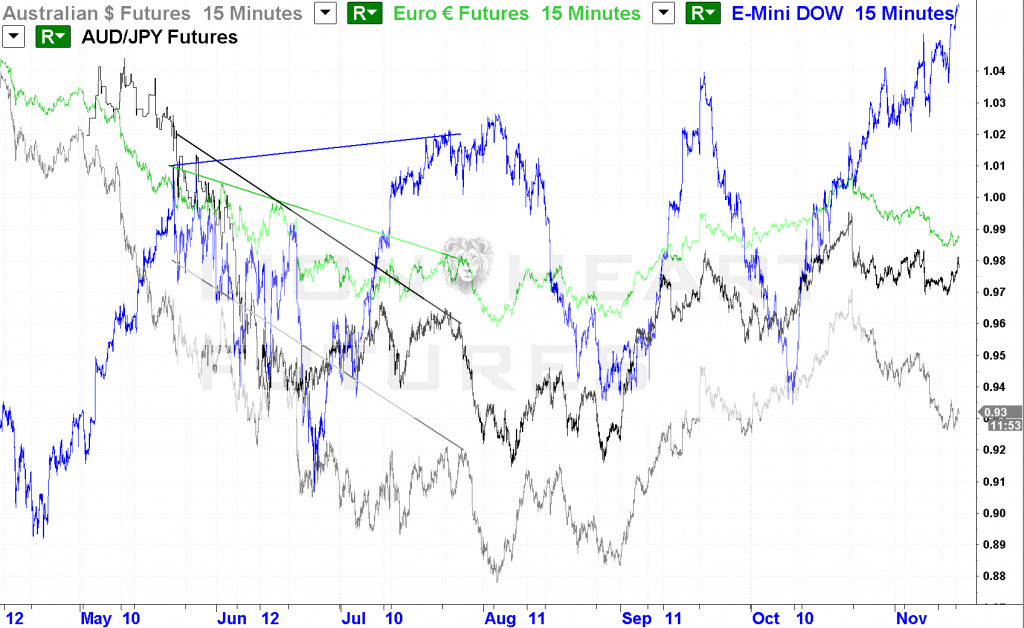

Stock index future divergence from currency markets;

and

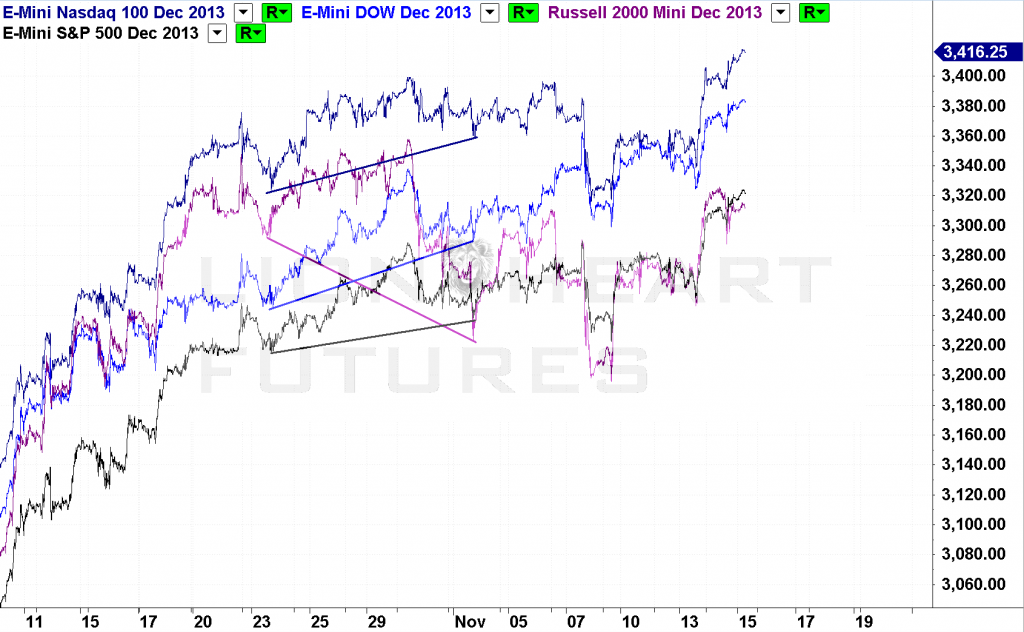

Divergence between stock index futures

3. Relates to scenarios such as the following;

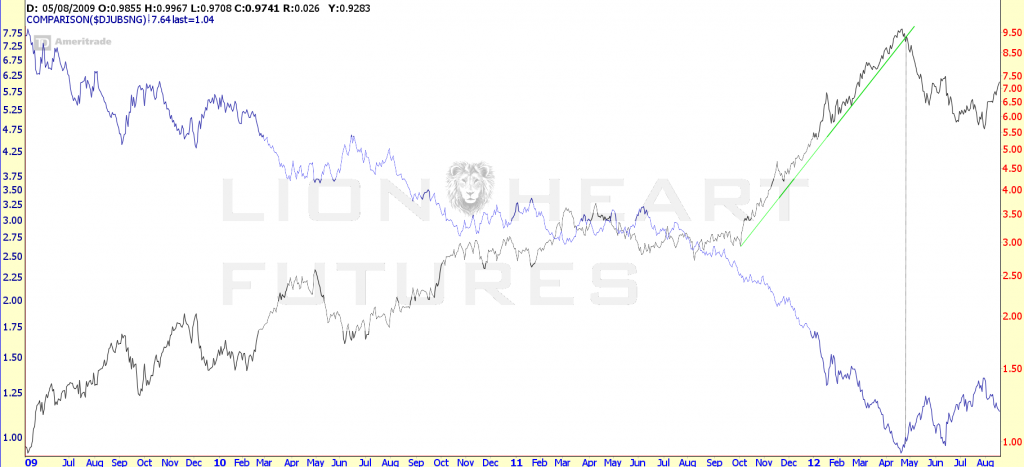

On 7th April 2012 I identified a bubble in the relative cost of energy per MMBtu when comparing Crude Oil to Natural Gas, the point where the trend in the ratio broke signalled the low in Natural Gas

The ratio in log of Crude Oil (cost per MMBtu) to Natural Gas (cost per MMBtu) shown in comparison to Natural Gas;

No comments:

Post a Comment