During my previous efforts there were a few things I picked up from watching the markets regularly, that I may be able to capitalise on. There are some patterns that occur between equity markets and currency markets that could be traded.

Let's find out.

Clearly there are a different set of risks and opportunities compared to the type of trading I was previously engaged in so I'll need to study this for a while, probably once I've developed a basic strategy I will test it out on a simulated account first, to see how I get on. There are some attractive aspects, such as your position being hedged all the time, even if it's not a full hedge, and no stops would be involved, so the entry probably would not need to be so finessed as compared to my previous strategy (Strategy II), although I would probably still set emergency stops well wide of the market, just in case something adverse happened, certainly on the long leg of the spread anyway.

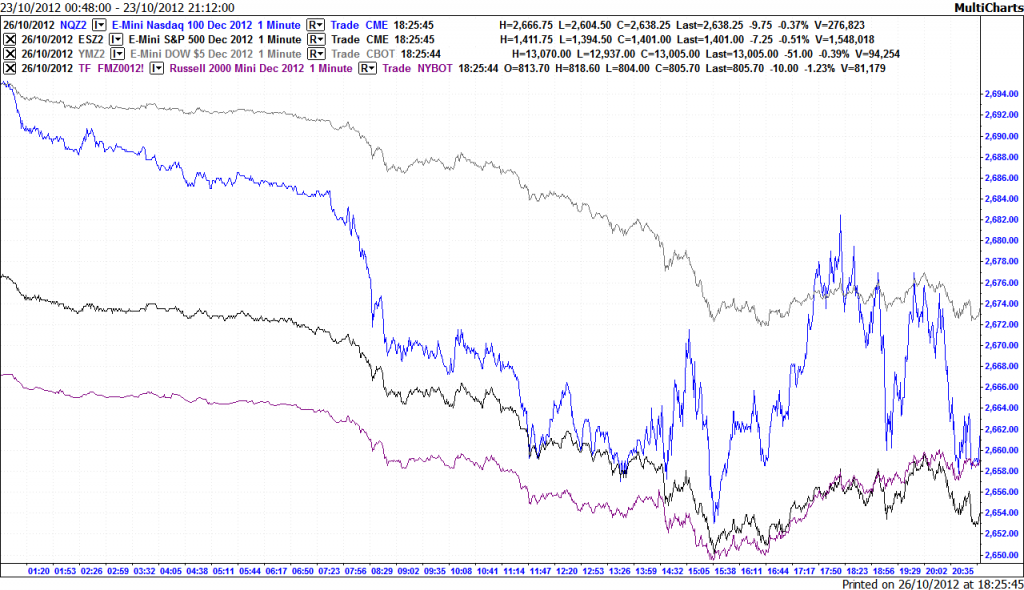

Here's one I made earlier - up so far.

E-MIni NASDAQ futures

The Spread

E-mini Dow Futures

No comments:

Post a Comment