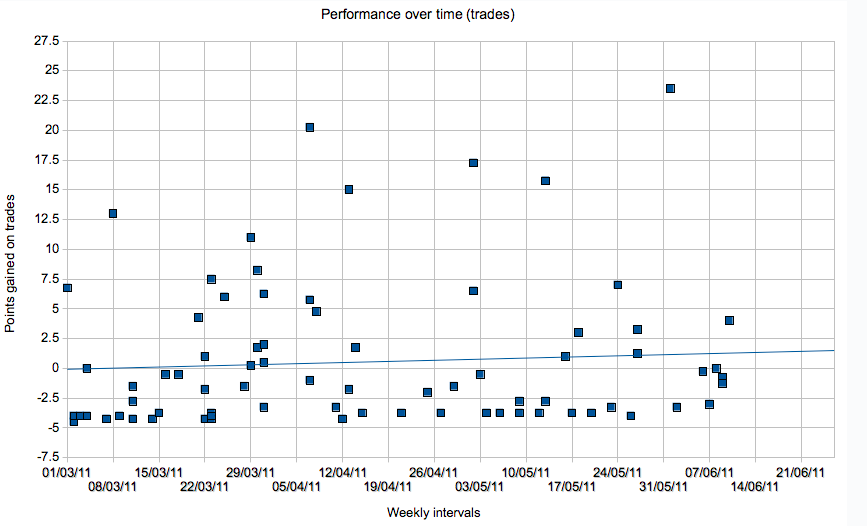

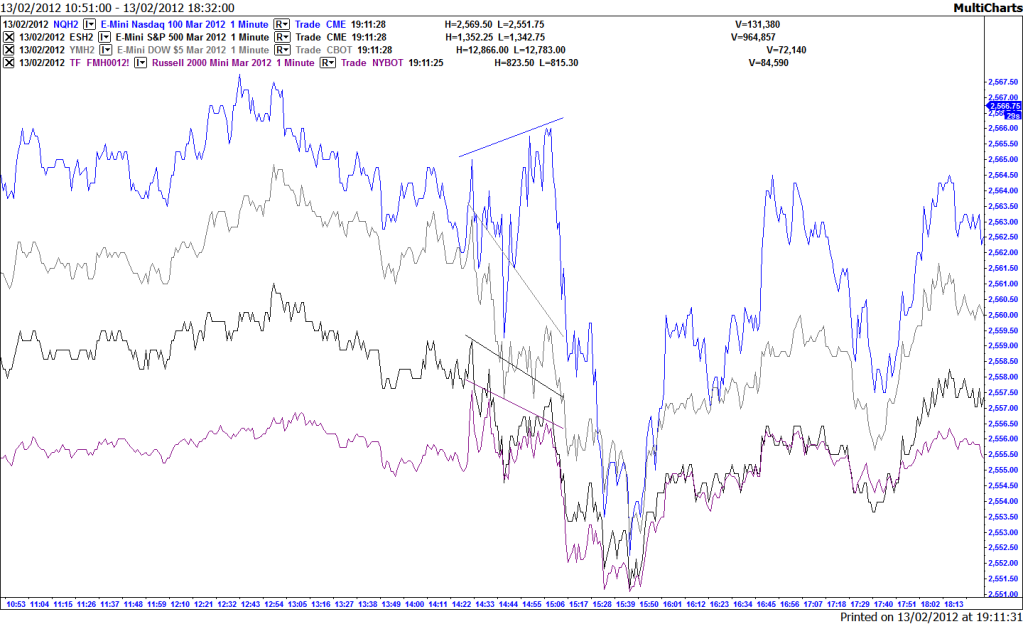

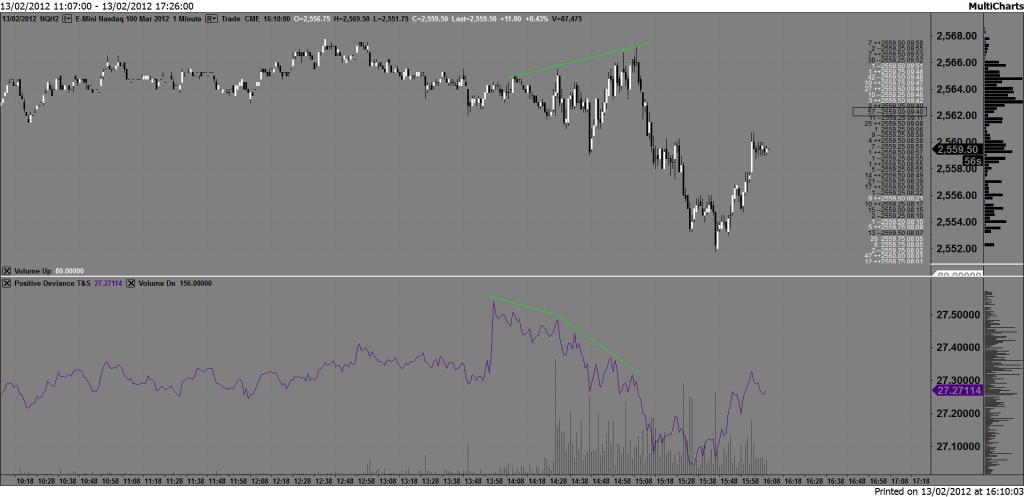

A great day today, 3 trades, 3 wins

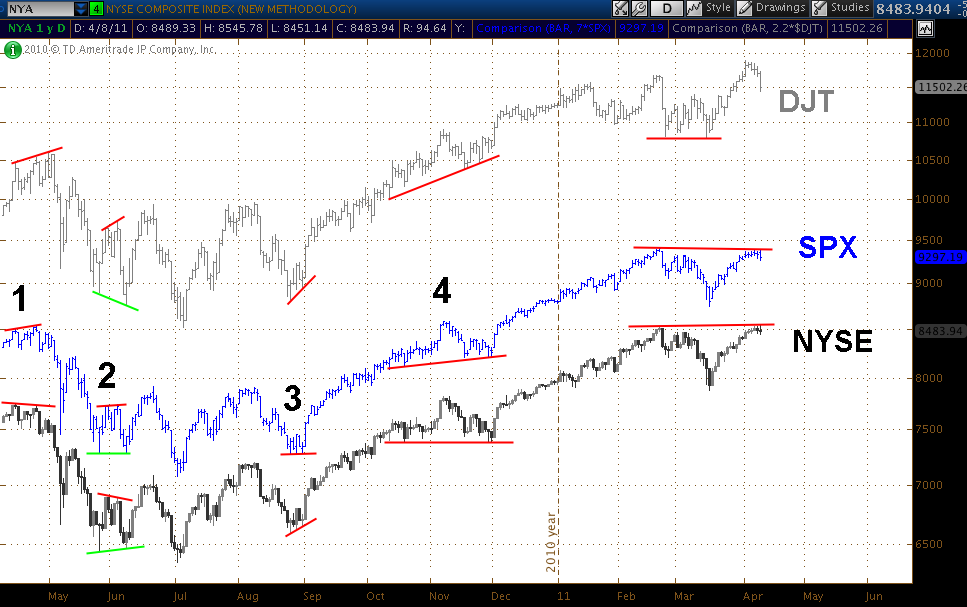

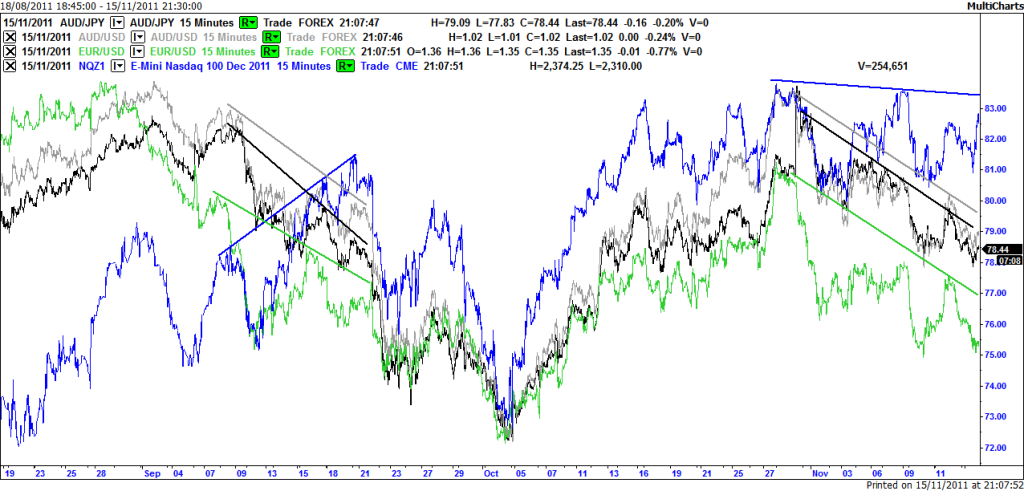

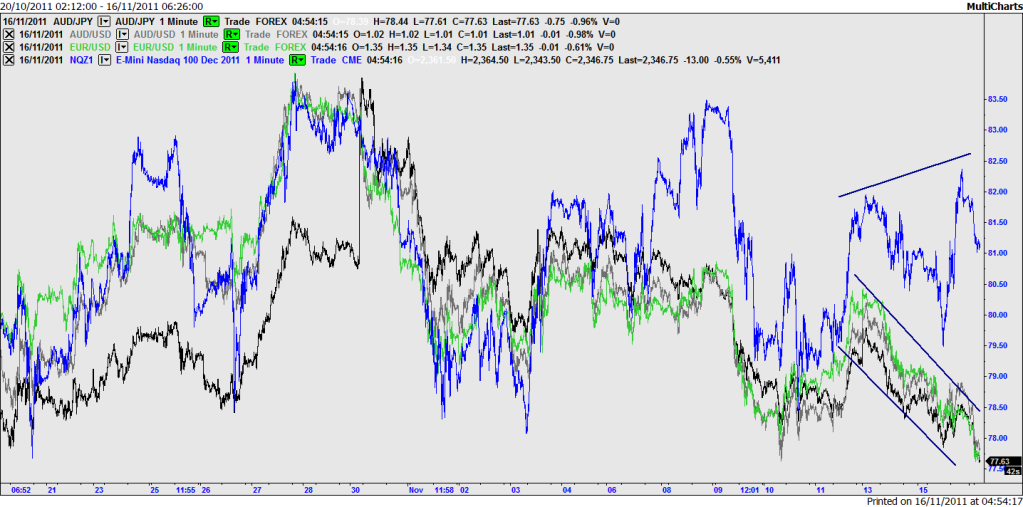

E-Mini Dow futures

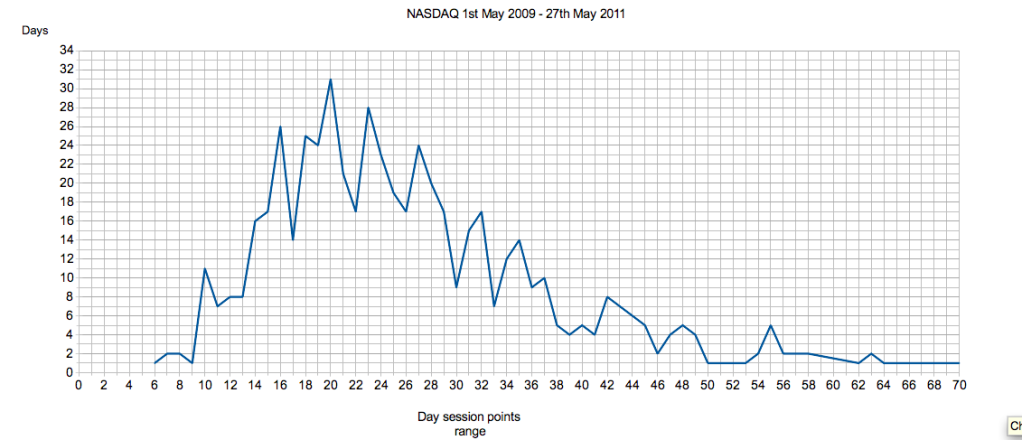

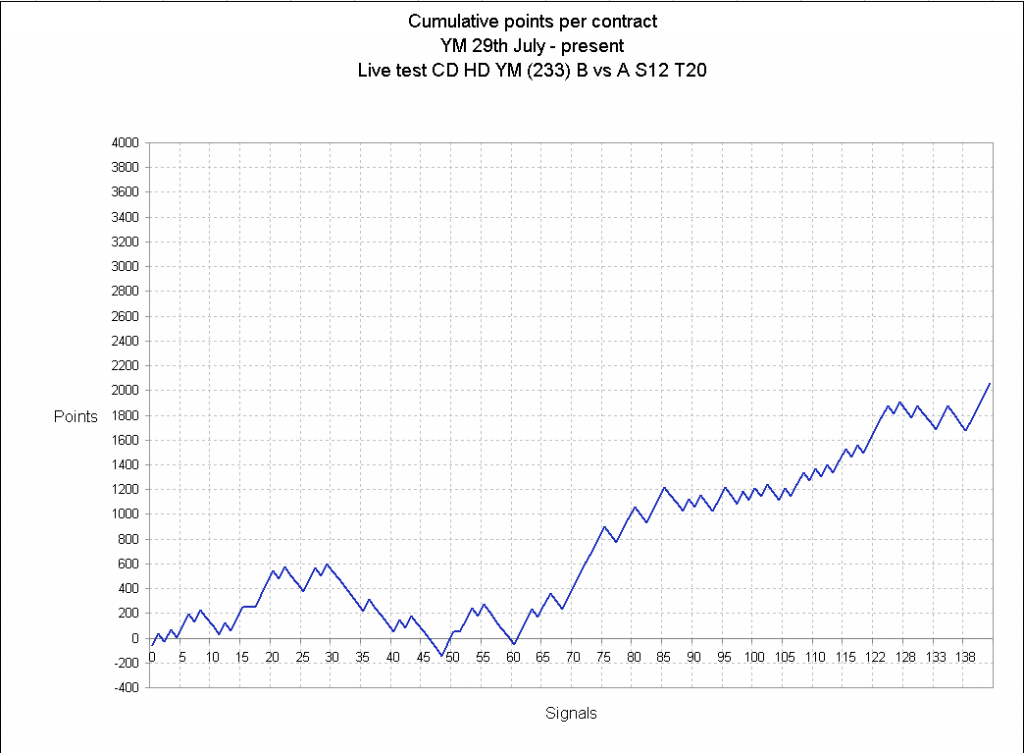

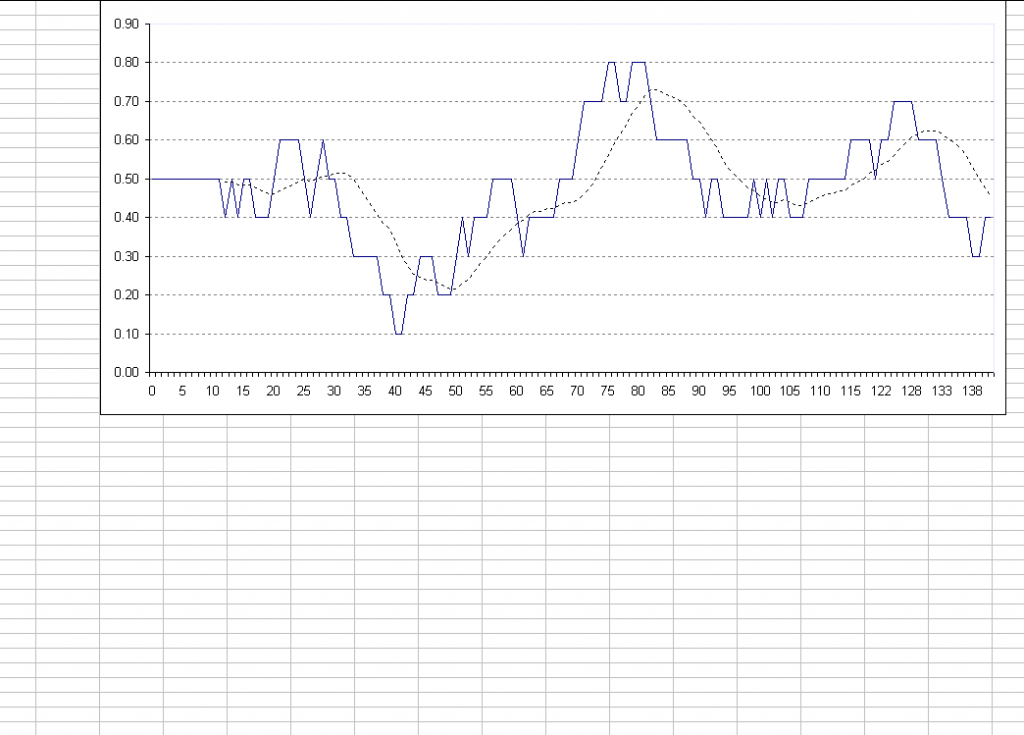

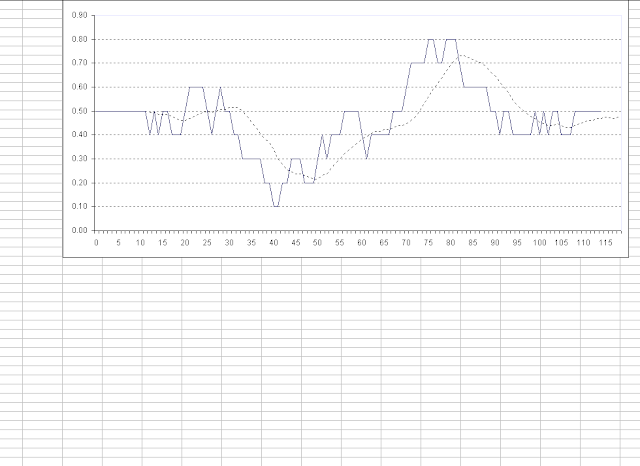

The specific people I'm competing with in the futures market with this strategy are the retail traders active in the market. They are the most inexperienced participants in the market and therefore the easiest to target. My strategy aims to find times in the market where they as a group have put themselves into a difficult position whereby if the market moves against them then most of them get taken out, with the professionals operating in the market cashing in as a result. I take the other side when I spot these opportunities. It doesn't always work of course but today it has worked beautifully.

I've just set up a Limited company at companies house that I intend to trade through. It's something I've thought about for a while and now is the time. The deeper I've become involved with trading the more serious it's getting and of course the next step after the initial phase is to step out and perhaps look at trading more contracts at some point in the future, in order to do that I need to trade with the safety net of a Limited company since if some highly unexpected market event happened that got me into serious difficulty I don't want my personal assets to be on the line. Trading is a serious business, especially when you are dealing with high value futures contracts. If I approach it in a more professional businesslike way that can only be beneficial.

My wife is pregnant and due mid February and there is absolutely no way I'm going to let that get in the way of this opportunity. When he is older, I will be telling my son that you can achieve anything you want in life if you put a massive amount of belief and effort into it.

In order to do this I need to prove I can do it myself otherwise the message is going to ring very hollow.